Which of the Following Best Describes the Npv Profile

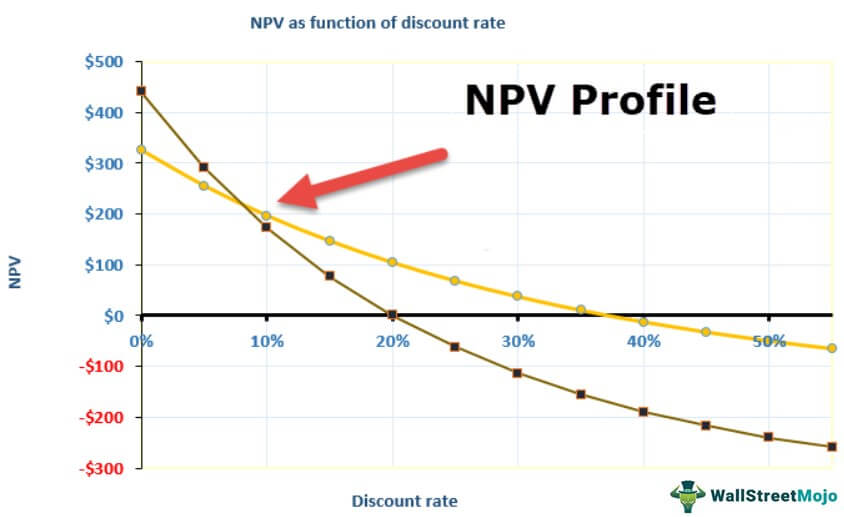

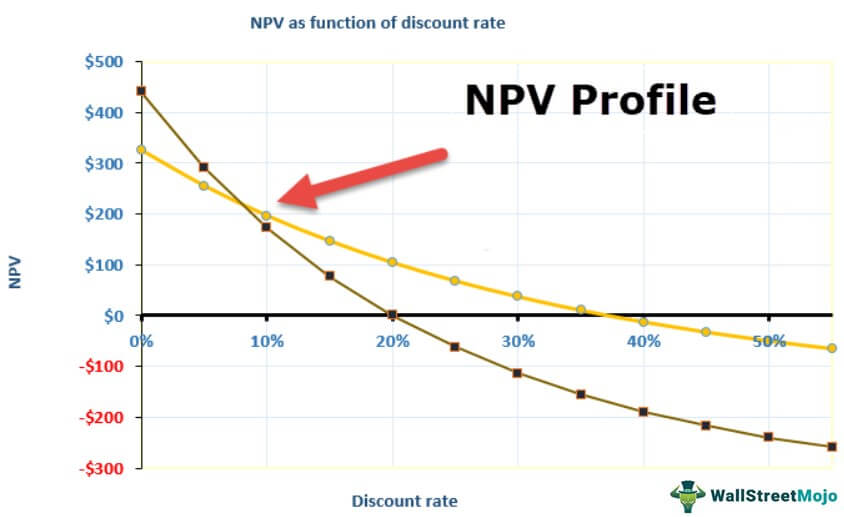

A graph. In order to arrive at the project selection decision the following criteria is followed.

Npv Profile Definition Components How To Plot An Npv Profile

Present Value of Goals Approach.

. That when applied to the future cash flows makes them equal to the initial cash expenditures. NPV rankings are affected by external interest rates or discount rates. 110000 at the end of Year 1 and -.

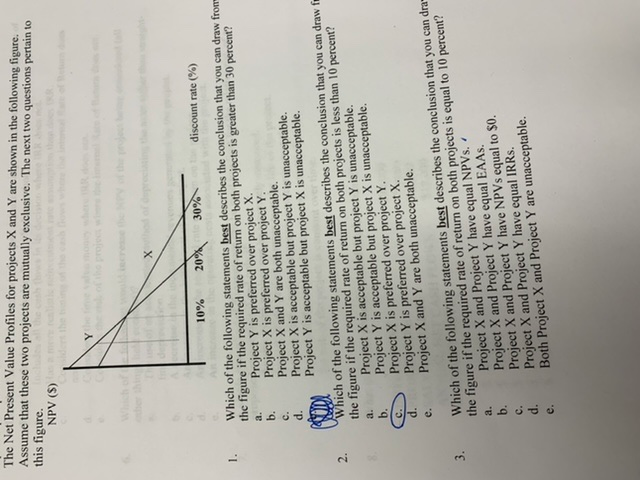

The crossover rate ie the rate at which Projects A and B have the same NPV is greater than either projects IRR. Which of the following best describes the NPV profile. NPV profiles for independent projects with normal cash flows will intersect.

A graph of a project NPV as a function of possible capital costs D. For example 8 percent. None of these statements is correct.

The point at which the discount rate 0 and the NPV is the sum of the undiscounted cash flows for the project. The values of the NPV appear on the vertical axis while the cost of capital or WACC appears on the horizontal axis 1. Year 0 1 2 Project X 8000 50000 50000 Project X has two IRRs of 25 and 400.

The NPV and IRR methods will select the same project if the cost of capital is greater than 10 percent. Which of the following statements best describes your optimal recommendation ie the analysis and recommendation that is best for the. Now you must make a recommendation on a project that has a cost of 15000 and two cash flows.

Step 1 of 2. Cash flows that occur after payback. A Payback Period b Internal Rate of Return c Net Present Value d Accounting Rate of Return 2 What is an advantage of the Pay Back Period method.

The projects cash inflows equal its cash outflows in present dollar terms. As a Chegg Study subscriber you can view available interactive solutions manuals for each of your classes for. A NPV profile is a graph showing the relationship between a projects NPV and the firms cost of capital.

A project has a net present value of zero. The CFO believes project acceptance should be based on the NPV but Steve Camden the president insists that no project should be accepted unless its IRR exceeds the projects risk-adjusted WACC. You are on the staff of Camden Inc.

Its cost of capital is 15. Finally analyse the NPV value that you have. The NPV profile is a graph of a projects NPV as a function of possible capital costs.

The point where a projects net present value profile crosses the horizontal axis indicates a projects internal rate of return. The MIRR assumes that the cash inflows can be reinvested at the cost of capital. A graph of a projects NPV over time.

Which one of the following best describes this project. You are considering a project X which has the following cash flows. Who are the experts.

All of these statements are correct. Which of the following statements is correct regarding the NPV profile. For example 18 percent.

A graph of a projects NPV over time C. Project A has an internal rate of return IRR of 15 percent. The project requires no initial cash investment.

Finance is the science of determining value to things owned by us services used by us and the decisions that we make. The MIRR statistic is different from the IRR statistic in that_____. Step-by-step explanation A projects NPV profile is a graph of its NPV that corresponds to various values of discount rates or cost of capital.

Project risk profile C. Graph of a projects NPV as a function of possible IRRs. Multiple Choice A graph of a projects NPV as a function of possible IRRs.

Which of the following statements best describes Project X. Which one of the following best describes this project. The reinvestment rates used by NPV are more conservative and therefore are economically more relevant.

Reject the project is. IRR ranking assumes reinvestment at opportunity cost of capital that isless realistic and economically less relevant. Which one of the following will decrease the net present value of a project.

The NPV and IRR methods will select the same project if the cost of capital is less than 10 percent. The IRR appears at the crossover point or where the two profiles intersect. Net present value NPV profile of the company refers to the graph which shows the net present value of the project under consideration with respect to the corresponding various different rate of the discount where net present value of the project is plotted on the Y-axis of the graph and the rate of the discount is plotted on the X-axis of the graph.

The correct answer is A. The NPV profile graph is inconsistent with the statement made in the problem. See the answer See the answer done loading.

Accept the project if NPV is greater than zero. The IRR of the project. A It considers all cash flows.

Describe the type of people who use the financial markets. 1 Which of the following best describes the discount rate. NPV refers to the present worth of a project determined by deducting the initial cost from the present value of expected future cash flows.

The point at which the NPV is highest. The project has no cash flows. The NPV profile shows how NPV changes in response to changing cost of capital.

In an NPV profile the point at which the profile crosses the x-axis is best described as. Which of the following statements best describes this situation. The NPV values are plotted on the Y-axis and the WACC is plotted on the X-axis.

The IRR appears as the intersection of the NPV profile with the x-axis. Group of answer choices. Both projects have a cost of capital of 12 percent.

Project B has an IRR of 14 percent. NPV 0 Accept. NPV Profile NPV profile of a project or investment is a graph of the projects net present value corresponding to different values of discount rates.

The project has a zero percent rate of return. The projects cash inflows equal its cash outflows in current dollar terms. Which of the following best describes the NPV profile.

The NPV is zero Neither payback period nor discounted payback period techniques for evaluating capital projects account for. NPV Calculation Step 5. Which of the following best describes the financial approach that uses quantitative benchmarks that provide guidelines of where a clients financial profile should be.

Modern Portfolio Theory Markowitz Portfolio Selection Model Modern Portfolio Theory Financial Statement Analysis Positive Cash Flow

Solved The Net Present Value Profiles For Projects X And Y Chegg Com

20190913 200946 Jpg Which One Of These Best Describes The Npv Profile Given Non Normal Cash Flows X Sorry Your Answer Is Incorrect Read About Course Hero

No comments for "Which of the Following Best Describes the Npv Profile"

Post a Comment